The Global Renaissance of Radiopharmaceuticals

Despite having been utilised in patient healthcare for decades, albeit predominantly as diagnostic tools, radiopharmaceuticals have remained relatively unexplored as a class of therapeutics. However, this is changing.

Recent years have seen radiopharmaceuticals rapidly gain global interest as therapeutics that find application in an extensive and diverse array of indications. Most significantly, radiopharmaceuticals are emerging as the next breakthrough in the targeted treatment of cancer due to their high efficacy, good safety profile, and targeted mechanism of action.

By all accounts, we are in the midst of a radiopharmaceuticals renaissance. So much so, the global radiopharmaceuticals market is projected to grow to USD 35 billion by 2031, with big pharma looking to achieve commercial success in the field. With the successful commercialisation of pharmaceuticals inherently tied to a robust patent portfolio, the development of a strategically layered patent portfolio will serve to extend market exclusivity.

But in the global race to capitalise on a growing radiopharmaceutical market, is Australia keeping up?

A growing market and evolving landscape

The global radiopharmaceutical market is currently valued at USD 6.3 billion. Driven by the advancement of personalised medicine, this is projected to grow to USD 35 billion over the next decade.1 And big pharma is looking to capitalise on this growth. The field has recently seen several billion-dollar acquisitions take place in an effort to strengthen both pre-clinical and early-stage clinical radiopharmaceutical pipelines.

Eli Lilly was the first to show the extent of its renewed interest in radiopharmaceuticals, completing its acquisition of Point Biopharma in December 2023 for USD 1.4 billion.2 In doing so, Lilly acquired Point’s healthy pipeline of pre-clinical and clinical stage radioligand therapies in development for the treatment of cancer. Significantly, this included 177Lu-PSMA I&T which had earlier been granted fast track designation by the FDA for the treatment of patients with metastatic castration-resistant prostate cancer (mCRPC) on the back of positive Phase III clinical trials.3 CEO of Point Biopharma, Joe McCann, stated “the combination of Point’s team, infrastructure and capabilities with Lilly’s global resources and experience could significantly accelerate the discovery, development and global access to radiopharmaceuticals”.4

Bristol Myers Squibb followed suit in February 2024, completing its acquisition of RayzeBio Inc. for a staggering USD 4.1 billion, and with it, its differentiated actinium-based radiopharmaceuticals platform, 225Ac-DOTATATE.5 And earlier this year, Novartis similarly acquired Mariana Oncology, and its lead preclinical actinium-based radiopharmaceutical portfolio to treat solid tumours, for USD 1 billion.6

Australia is keeping up

Telix is leading the way in Australia , being recognised in 2023 as the highest achieving company for international growth.7 Driving this growth was the market launch of Illuccix®, a 68Ga-PSMA-11 injection, now on the market in the United States, Canada, and Australia.8 The ongoing success of Telix is supported by its comprehensive clinical pipelines spanning prostate cancer, kidney cancer, glioblastoma, sarcoma, and bone marrow conditioning indications.9

Several other Australian companies are well-positioned to emulate the success of Telix. Of note, and on the back of AUD 9.8 million in Federal funding, AdvanCell has recently established its flagship Australian manufacturing facility in Brisbane.10 It is simultaneously forging ahead with the development of targeted alpha-therapies (TAT), including 212Pb-ADVC001, a 212Pb-PSMA-based targeted therapy.11 Clarity Pharmaceuticals has completed successful equity raises to support its advancement of copper-based radiopharmaceuticals. Its healthy pipeline includes mid-late-stage diagnostic and theranostic clinical candidates.12

To further support the industry, the ARC Research Hub for Advanced Manufacture of Targeted Radiopharmaceuticals (AMTAR) was established in 2023. The initiative brings together researchers and industry partners, including those mentioned above, whose aim is “to make possible the reliable manufacture of radiopharmaceuticals at a scale to benefit all”.

Patent filings as a measure of research, development, and commercialisation

The successful commercialisation of pharmaceuticals is inherently tied to a robust patent portfolio. A strategic patent portfolio will extend a pharmaceutical company’s period of market exclusivity, thereby delaying a competitor’s entry to market, and ultimately maximising the opportunity for the company to recoup research and development costs. And the commercialisation of radiopharmaceuticals is no different.

Radiopharmaceutical therapies provide multiple facets for obtaining patent protection. For example, patent protection may be granted in relation to the radiopharmaceutical per se, its use for treating indications, dosage regimens, formulations, combination therapies, and manufacturing methods. The more commercially relevant facets of the radiopharmaceutical therapy that are protected, the greater, and potentially longer, the period of market exclusivity.

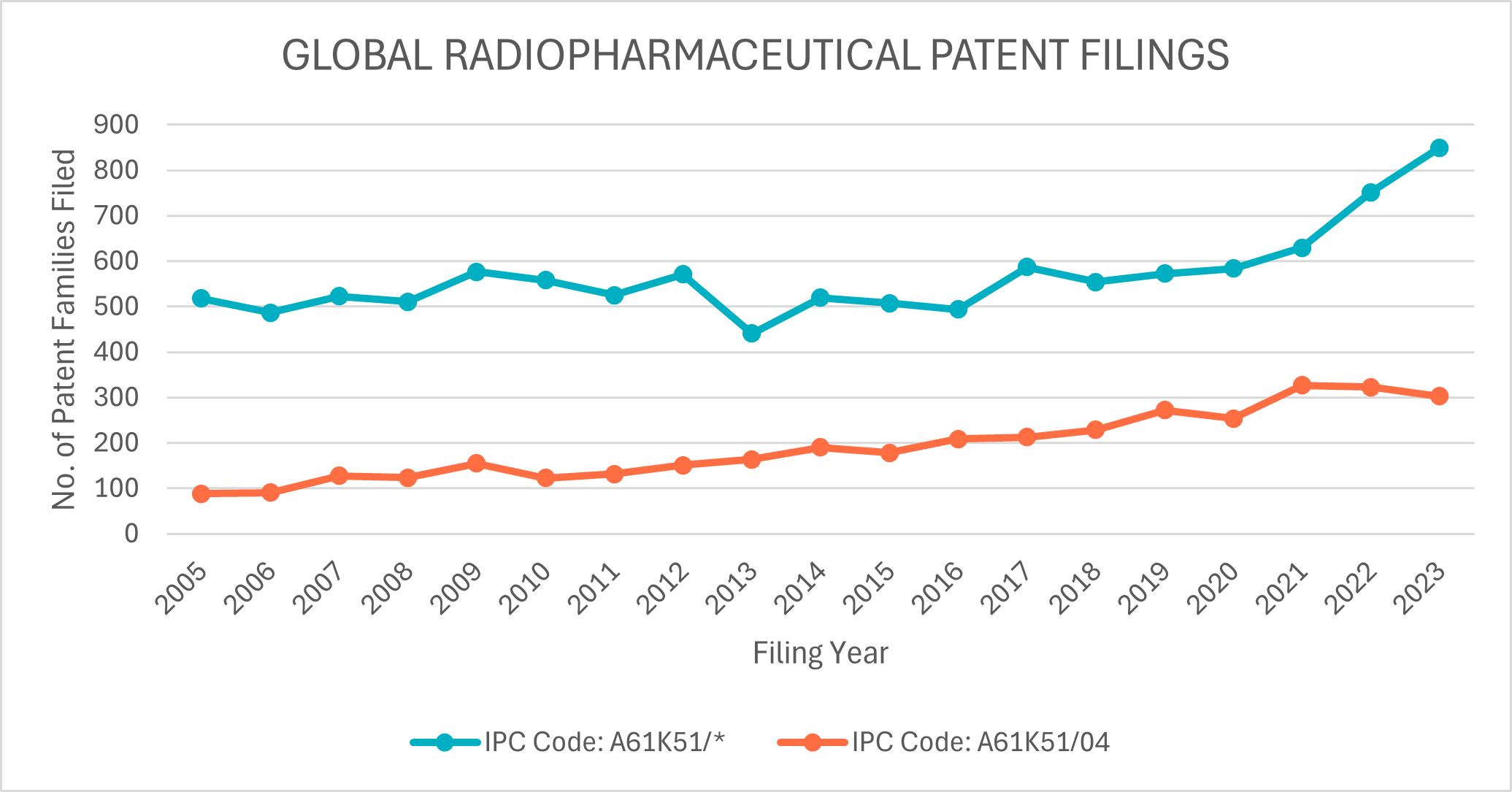

It therefore follows that global patent filings should evidence the current radiopharmaceuticals renaissance. While there are several means for searching global patent filings, a particularly valuable means is to search based on International Patent Classification (IPC) code. The IPC is a hierarchical classification system used primarily to classify and search patent documents according to the technical fields they pertain.13

IPC code A61K51 broadly designates “preparations containing radioactive substances for use in therapy or testing in vivo”. In this way, IPC code A61K51 provides a means to selectively search for patent documents relating to radiopharmaceuticals while not capturing traditional external radiotherapy. Within A61K51, IPC code A61K51/04 more narrowly designates preparations that relate to “organic compounds” (e.g. radioisotope conjugated to organic targeting compounds).14

A search of these IPC codes in PatentScope15 for the period of 2005 to 2023, shows that a total of 16,775 patent families have been filed globally. Unsurprisingly, a large majority – almost a third – of global patent filings have been filed with the United States Patent Office. Australia represents a tiny fraction of these filings (approximately 0.4%).

Interestingly, a sharp increase in A61K51 patent filings over the 2021 to 2023 period is observed (see Figure 1). In contrast, A61K51/04 patent filings have remained steady over the same period, perhaps indicating that patent filings directed to organic small molecule radioisotope conjugates are not responsible for this sharp increase globally.

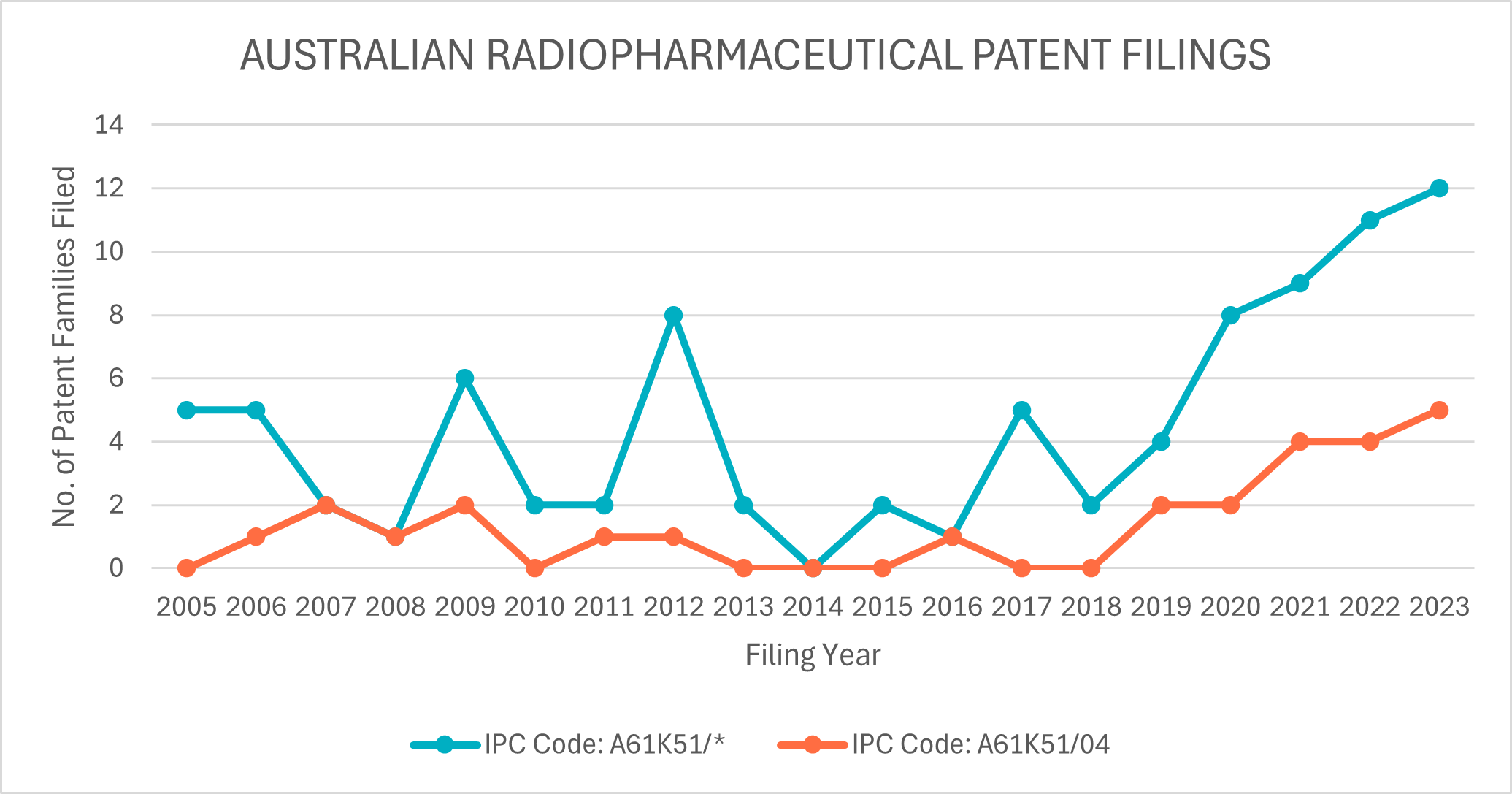

But is Australia keeping up or otherwise falling behind? Positively, a search of Australian radiopharmaceutical patent filings indicates the former. Limiting the search to patent filings comprising at least one Australian applicant, shows both a sharp increase in A61K51 and A61K51/04 patent filings over the same period (see Figure 2).

Historically, the majority of patent filings have stemmed from the traditional research sector. However, in the last five years, Telix, AdvanCell, and Clarity Pharmaceuticals have emerged as the dominant Australian filers in the field.

Australia is positioned to compete for its share of the growing radiopharmaceutical market

As evidenced by both the growing and evolving landscape of companies focusing on the development of radiopharmaceuticals, and the increasing number of patent filings in the field, Australia is keeping up with the global radiopharmaceuticals renaissance.

We have seen time and time again that commercial success in the pharmaceutical field is best supported by a robust patent portfolio. The radiopharmaceutical field is no exception. In looking to maximise commercial success, pharmaceutical companies should develop strategically layered patent portfolios encompassing multiple facets of the radiopharmaceutical therapy that serve to extend market exclusivity.

The sentiment is clear – there is a global race to capitalise on the growing radiopharmaceuticals market, and Australia is well-positioned to be competitive.

Work with Our IP Strategy Team

Innovators in radiopharmaceuticals and targeted radiotherapy face a rapidly evolving landscape. A well-crafted IP strategy is essential to protecting breakthroughs and ensuring market success. Our team is here to help you navigate this complex field with tailored patent solutions.

Footnotes

MEDraysintell Nuclear Medicine Report 2022

** This article was originally featured in The Journal of AusBiotech, October 2024, page 12