Traversing a dynamic ADC patent landscape

As the ADC patent landscape is more dynamic than ever before, it is important to have an understanding of third-party patent rights in the space. This article, the second in our ADC series, highlights the role that patent landscaping and FTO analyses can play in strategic decision-making for the development and successful commercialisation of ADC technology.

Research into the therapeutic potential of antibody-drug conjugates (ADCs) has experienced a resurgence over the past decade, with key players such as Daiichi Sankyo, Genentech, and Seagen leading the field. This research leads to innovation, which in turn is supported by new patent filings. As a result, the ADC patent landscape is now more dynamic than ever before.

In the first article of this ADC series, Targeted patent strategies for protecting ADCs, we discussed strategic considerations for protecting ADC innovations.

In this Part 2, we explore the importance of evaluating the ADC patent landscape and undertaking freedom to operate (FTO) analyses to identify third-party patents.

Part 2: Insights into patent landscape and FTO analyses

As discussed in Part 1, several aspects of ADC technology may form the subject of a granted patent, including the ADC product per se, the individual components of the ADC, manufacturing methods, and methods of use.

Having a granted patent is a valuable commercial tool in that it excludes others from making, using, and selling the patented invention. However, whether a party is free to make, use, and sell an invention itself, and ultimately commercialise that invention, depends on the patents of others. It is therefore critical to identify third-party patents.

So how can third-party patents be identified?

Patent landscape searching and FTO analyses will each identify third-party patents. They are distinguished in that landscape searching is a focused review to identify key third-party patents, or a sub-set of third-party patents, in the relevant field, whereas FTO analyses is a comprehensive review of all third-party patents encompassing the commercial product (or process) to identify patents that specifically present as a potential barrier to commercialisation. With both, the scope of searching and/or analyses can be tailored based on a company’s budget and overall objectives.

Having an understanding of the patent landscape, and any potentially blocking patents, means informed decisions can be made to strategically direct further research and development, resources, and investment, thereby mitigating any risks and maximising the potential for commercial success.

Searching patents in the ADC field requires a considered strategy

Historically, research and development of ADCs has been challenging due to inherent complexities – specificity, payload delivery, bioavailability, manufacturing, and degradation/stability issues. More recently, research and development in the field has borne significant advances in ADC technology, with each of the antibody, linker, and conjugated drug component providing unique opportunities for innovation.

As a result, the ADC patent landscape is dynamic, and replete with examples illustrating the various opportunities for innovation.

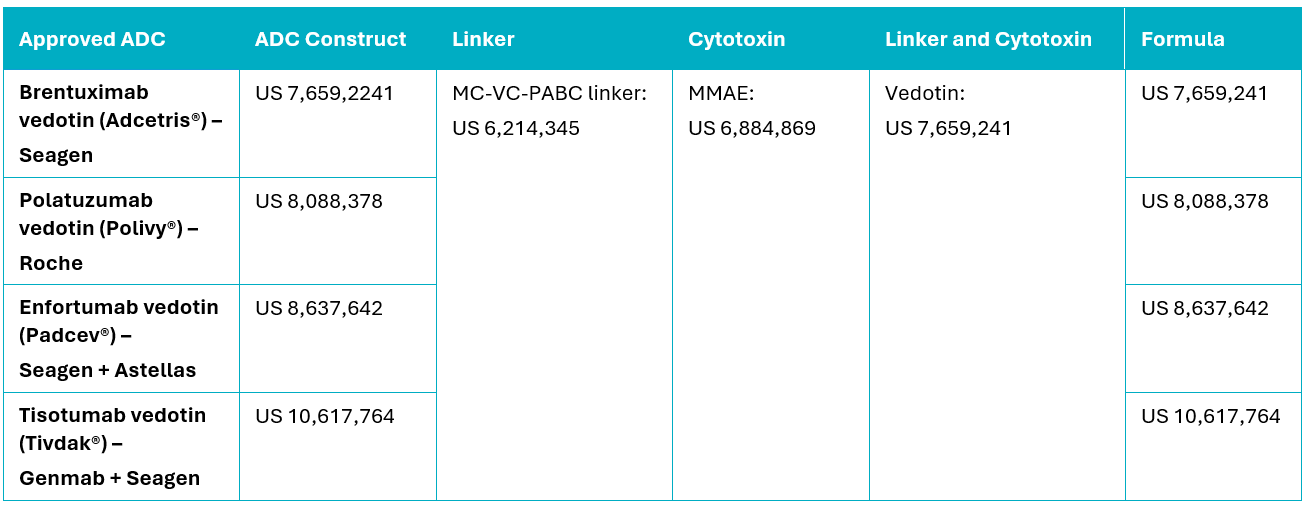

One such example is Vedotin, which is Seagen’s1 MC-VC-PABC linker and MMAE cytotoxin combination. Vedotin per se is covered by US Patent No. 7,659,241 and was first used in the FDA-approved ADC, Adcetris®. Vedotin has since been incorporated into three other FDA-approved ADCs, being Polivy®, Padcev®, and Tivdak®. Despite, the use of the same linker-cytotoxin combination, each of these ADCs is protected by additional patents encompassing the unique ADC construct, for example, in combination with different antibodies and target antigens (Table 1). Further secondary patents often encompass other commercial aspects such as formulations, dosages, therapeutic combinations, manufacturing methods, and methods of use.

Table 1. FDA-approved ADCs comprising Vedotin and the patents covering various components.

Given that the ADC per se may form the subject matter of a granted patent, as well as each of the individual components of the ADC, patent protection may be layered and complex. It is therefore essential to consider not only the overall ADC construct, but also each individual component of the ADC in isolation, when performing a patent landscape and/or FTO analyses.

Exemplary searches encompassing each component of the ADC may include:

- the antibody per se (e.g., defined by sequences, antibody format, epitopes, and/or functional properties)

- the payload per se (e.g., with altered functionality such as reduced toxicity, enhanced potency, and/or minimized off-targeting effects)

- the linker per se.

Ideally, each component should also be searched in combination, for example, antibody plus payload, antibody plus linker, and payload plus linker. Searching the methods of conjugation may also be required, whether it be stochastic or site-specific conjugation, as well as any methods required for controlling antibody-to-drug ratios. Even further, it may be relevant to conduct searches around the synthesis/manufacture of each component (e.g., monoclonal antibody production methods, antibody purification methods, linker chemical synthesis).

Undertaking patent landscape searching and FTO analyses in the ADC field is complex and requires a considered strategy in line with commercial objectives.

The benefits of conducting timely patent landscape and FTO analyses

Targeted patent searches may be successfully employed at various stages of product development. For example, an early patent landscape search may identify:

- emerging areas of innovation

- key innovators in the field

- potential collaborators, licensees/licensors, and competitors

- geographical regions of interest

- insight into underdeveloped areas of innovation and potential avenues for patentability.

Being armed with this information at an early stage leads to informed decisions to aid research and development. For example, in 2023 Merck and Daiichi Sankyo announced a $22 billion global development and collaboration agreement to leverage Merck’s experience in oncology to expand the clinical development of Daiichi Sankyo’s ADCs across multiple cancer types.2

Undertaking an FTO analyses will typically occur when the general commercial direction has been decided. In this way, the analyses can be targeted so that only patents strictly presenting as a commercial barrier will be identified. An FTO analyses should identify:

- third-party granted patents or pending patent applications with claims encompassing one or more aspects of a commercial product (e.g., the product per se, individual components, the manufacturing method, dosages, methods of use)

- jurisdictions where such third-parties exist

- projected expiry dates of third-party patents.

There is strategy in the timing of undertaking FTO analyses – not too early that the information obtained is not relevant to the ultimate commercial product, yet not too late that the commercial product cannot be altered so as to avoid any identified FTO barriers. For instance, companies in initial stages of developing their ADC synthesis/manufacturing may wish to conduct an FTO to provide guidance to their R&D teams to help avoid developing processes that infringe third-party patents.

FTO analyses is a key step when getting ready for market entry

Ahead of market entry, it is recommended to undertake comprehensive FTO analyses encompassing all areas of commercial activity. From here, it may be necessary to assess the scope, validity, and enforceability of any identified granted patents, and commence ongoing surveillance of any identified patent applications.

An FTO analysis can also be useful when considering licensing or selling the technology, for example, as part of a due diligence analysis. No doubt detailed FTO analyses have played a vital role in the value of Pfizer’s $43 billion acquisition of Seagen3 and $1.05 billion licensing agreement with Nona Biosciences4.

Having a complete understanding of the potential FTO risks ahead of the ADC product entering the market ensures that plans may be made for overcoming potential barriers.

FTO barriers can be overcome

Should a patent be identified as presenting an FTO risk, there are approaches that can be employed to address the potential barrier, for example:

1. Licensing of the patent.

Seeking a license to the potentially blocking patent is an option that has frequently been used in the ADC space. For example, Immunogen filed and obtained a patent describing Emtansine, a linker-cytotoxin construct, in US Patent No. 5,208,020. Genentech has since licensed this technology from Immunogen and used it to develop and commercialise their ADC, Trastuzumab emtansine (Kadcyla®).5

2. Considering the validity and enforceability of the patent.

The validity of the patent may be challenged by way of nullity actions, oppositions, post grant review/inter partes review, or revocation proceedings. A notable example is the dispute between Seagen and Daiichi Sankyo, where Seagen accused Daiichi Sankyo of infringing their US Patent No. 10,808,039 covering certain peptides conjugated to an antibody through various linkers. In response, Daiichi Sankyo filed a request for a post grant review of the US patent and earlier this year the United States Patent Trial and Appeal Board found all claims to be invalid.6

Staying a step ahead

While the current ADC space is complex, with a firm grasp of the technology and considered search strategy, the patent landscape can be navigated to provide invaluable insights and strategically direct further research and development, resources, and investment, to ensure commercial success.

For assistance in developing a tailored search strategy, please reach out to our team.

Footnotes

Acquired by Pfizer in 2023; “Pfizer Completes Acquisition of Seagen”, can be found at https://www.pfizer.com/news.

“Daiichi Sankyo and Merck Announce Global Development and Commercialization Collaboration for Three Daiichi Sankyo DXd ADCs”, can be found at https://www.merck.com/news.

“Pfizer Completes Acquisition of Seagen”, can be found at https://www.pfizer.com/news.

“Nona Biosciences, Pfizer Enter Global ADC License Agreement”, can be found at https://www.contractpharma.com.

“ImmunoGen and Genentech Sign Exclusive License Agreement”, can be found at https://investor.immunogen.com.

“US agency nixes Seagen patent, handing Daiichi Sankyo a win in long-running Enhertu entanglement”, can be found at https://www.fiercepharma.com.