Targeted patent strategies for protecting ADCs

Antibody-drug conjugates (ADCs) are an expanding market that is anticipated to surpass US$20 billion in sales by 2030. A considered patent strategy is essential to safeguard new developments and navigate a complex patent landscape amid increasing research and commercial activity. Explore these considerations in our two-part series.

Antibody-drug conjugates (ADCs) are a class of therapeutic that continue to demonstrate their considerable potential for the treatment of cancer. In recent years, there has been a resurgence in interest in the ADC space, with several ADCs receiving regulatory approvals for treating breast cancer and haematological malignancies. There has also been a proliferation of new partnerships and acquisitions in the space1, notably Pfizer’s US$4.3-billion acquisition of Seagen2, a leader in the ADC field. It is unsurprising that numerous companies are competing for a piece of a market that is anticipated to reach more than US$20 billion in sales by 20303. However, ADCs are not a new concept4 and as such, a considered patent strategy is required to protect new commercial developments, manage product approval timelines and navigate a complex patent landscape.

Antibody-drug conjugates

ADCs comprise of three components: an antibody, a chemical linker and a cytotoxic payload. The antibody component confers the ADC with a unique targeting ability, which allows the ADC to recognise and bind to specific cell surface antigens. Typically, the ADC is then internalised by the target cell, and the cytotoxic payload is released causing cell apoptosis or death (technology reviewed here5).

ADCs represent an advanced targeted approach for treating cancer and other malignancies. In the past couple of decades, thirteen ADCs6 have been approved by the US Food and Drug Administration (eight of which are also approved in Australia7). While ADCs were designed with the ultimate goal of overcoming dose-limiting toxicities seen with conventional chemotherapy, treatment-related adverse events are a common dilemma. The mechanisms underlying the toxicity profile of an ADC are related to each component (i.e., antibody, linker and payload). For example, “on-target toxicity” where the ADC targets healthy tissues expressing the antigen, the chemical properties of the payload (e.g., causing myelosuppression) and “off-target toxicity” through premature release of the payload.

Part 1: Patentability of antibody-drug conjugates

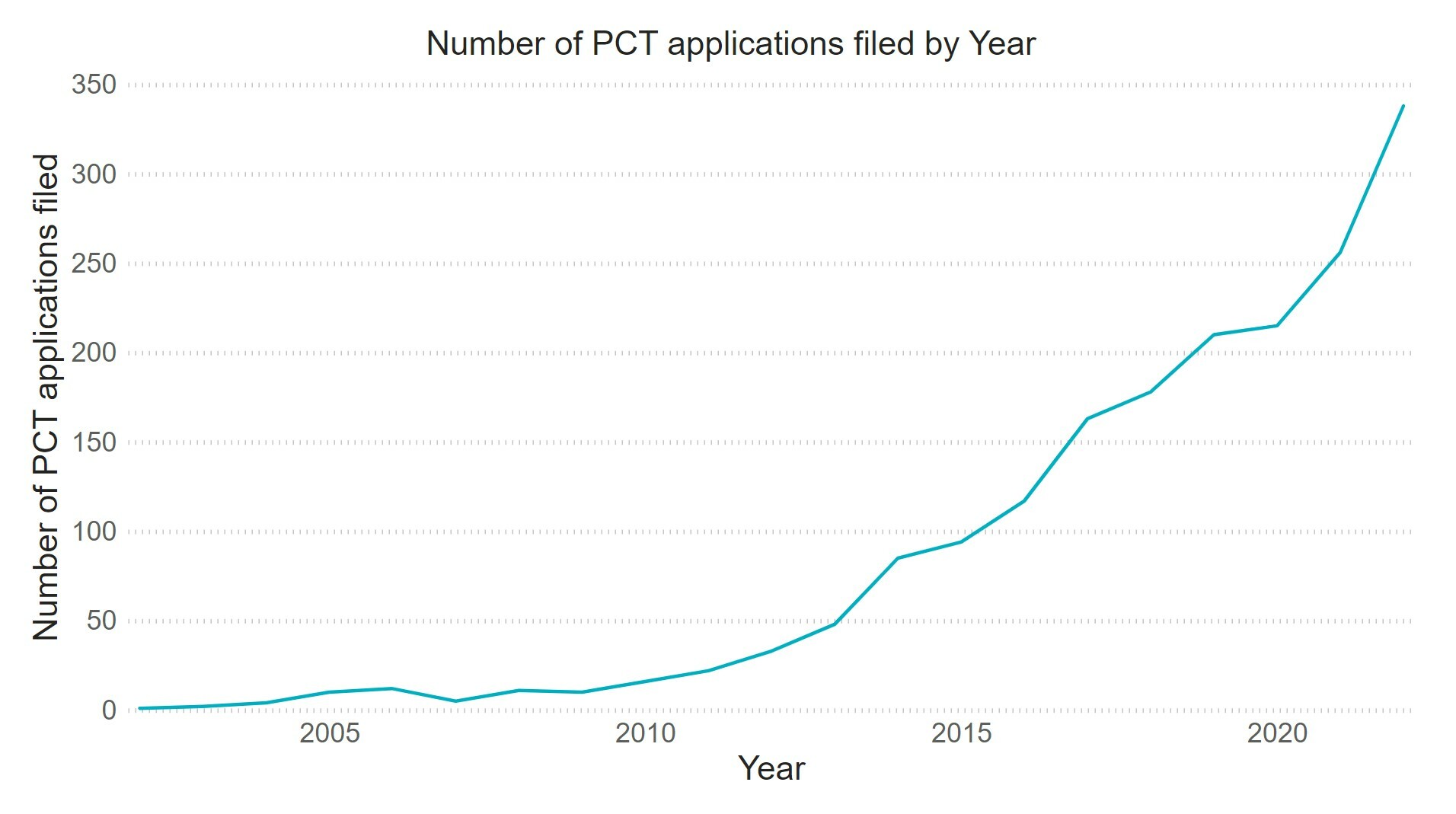

Even with these difficulties, patent filings with the term “antibody drug conjugate” in the title, abstract or claims have precipitously increased in the last 12 years with over 300 patent applications filed in 2022 and there is no sign of these filings slowing down (Figure 1).

Due to the flourishing activity in ADC development and the rocketing number of patent filings relating to ADCs, companies and investors will need to have a robust patent strategy in place in order to establish a market position and secure a return on investment.

Some key areas are discussed below, including new compositions of matter, methods of manufacture and methods of treatment (Figure 2). An effective patent strategy in the ADC space will leverage developments in one or more of these areas to position products for market exclusivity. As discussed in Part 2 of this series, companies must continually monitor developments in at least these areas to ensure freedom to operate and assess licensing needs and opportunities.

Composition of matter

Investors will often consider a ‘composition of matter’ patent to be the most valuable. This is in large part due to the breadth of coverage such a patent provides. Examples of compositions that can be patented in the ADC space include:

- Antibodies (e.g., defined by: CDRs, variable regions, antibody format, epitopes)

- Cytotoxic payloads

- Chemical linkers

- Combinations of the antibody + cytotoxic payload + chemical linker

- Formulations

It is particularly important for companies to have a clear understanding of the challenges and risks involved when looking to obtain broad ‘composition of matter’ protection of an ADC (or components thereof). A good illustration of this is demonstrated by the current state of patent law on antibodies, which is complex and ever-changing as the scope of what is considered an allowable antibody claim continues to shift within, and between jurisdictions. For example, the US Supreme Court decision in Amgen v Sanofi concluded that broad genus claims directed towards an antibody binding to a specific epitope were not allowable8. In contrast, the European Patent Office recently published their updated Guidelines for Examination, which included changes implying that claims to a genus of antibodies, including to an antibody binding to a novel epitope, remain allowable9. Australia has limited case law on the patentability of antibodies under the “new” Raising the Bar regime. However, as IP Australia’s examination practices continue to develop, it seems that initially restrictive objections in Australia can be overcome based on arguments that Australian law is more congruent with the European-style approach.

Another important consideration for companies and investors looking to obtain broad patent coverage is that, when the crux of the invention relates to one component of the ADC (e.g., a specific linker/payload attachment site), the remaining claim scope may cover a wide breadth of the other components (e.g., to any antibody). Alternatively, narrowing the patent claims to specific ADC components that have been approved in their own right (or in the context of a different ADC)10 can be an effective strategy for protecting a commercially important market.

Manufacturing methods

Despite the perceived importance of having composition of matter claims, due to product approval timelines often patent term on the product itself will have expired before or shortly after the product enters the market. New methods of manufacture can be extremely valuable in ensuring that sufficient patent coverage is available for investors and commercial partners after product approval.

Manufacturing ADCs is a complex process with numerous challenges faced in establishing safe, robust and scalable synthetic processes. There are several distinct stages: antibody design, the conjugation reaction, and the downstream purification and formulation of the ADC. ADCs have a fragile molecular structure prone to degradation requiring stringent management, storage and shipping of the finished products.

Examples of patentable manufacturing methods include:

- Monoclonal antibody production

- Conjugation methodology (e.g., stochastic or site-specific conjugation, or controlling drug-to-antibody ratio)

- Methodologies for increased purity and/or homogeneity during ADC production and/or purification

- Methods of manufacture of linker and/or payload reagents

Method of treatment

Method of treatment claims also provide useful additional, targeted coverage for novel uses of ADCs.

Examples of method of treatment patents that may provide significant value in the ADC space include:

- Dosing methods / dosage forms

- Clinical indications

- Specific patient subpopulations

- Combination therapies

Patent Strategy Summary

An effective patent strategy should be crafted to support a company’s particular commercial advantage. This commercial advantage may focus any one or more of the various aspects of technology as discussed above. It is of paramount importance that a company is clear on their particular competitive advantage as they jostle for a position in an increasingly crowded market.

Of course, given the wide array of components that can be protected by patents, it is necessary to have a comprehensive understanding of patent landscape and whether you have freedom to operate or need to consider licensing or other agreements. We discuss freedom to operate considerations in Part 2 of this series.

To ensure your competitive edge in the ADC space, please reach out to our IP team for help in developing an effective patent strategy tailored to your unique advantage.

Footnotes

“Caris Life Sciences Announces Partnership with Merck KGaA, Darmstadt, Germany to Discover Novel Cancer Targets and Accelerate First-In-Class Antibody Drug Conjugate Development", Caris Life Sciences, 2024.

“Corbus Pharmaceuticals expands oncology pipeline with the addition of a clinical stage Nectin-4 targeting Antibody Drug Conjugate (ADC)”, Corbus Pharmaceuticals, 2023.

“Synaffix Enters $2 Billion License Agreement with Amgen”, Synfaxxi, 2023.

“Hummingbird Bioscience and Synaffix Enter $150m License Agreement”, Synaffix, 2023.

“AstraZeneca enters license agreement with KYM Biosciences for CMG901, a Claudin-18.2 antibody drug conjugate”, AstraZeneca, 2023.

“Tubulis Announces Strategic License Agreement with Bristol Myers Squibb to Develop Next Generation ADCs for the Treatment of Cancer Patients”, Tubulis, 2023.

“Biotheus Expanded Their Partnership with Hansoh Pharma for Developing EGFR/cMET Bispecific Antibody-Drug Conjugates”, Biotheus Inc., 2024.

“Pfizer Invests $43 Billion to Battle Cancer”, Pfizer, 2023.

Strebhardt K, Ullrich A. Paul Ehrlich’s magic bullet concept: 100 years of progress. Nat Rev Cancer. 2008;8:473–80.

Riccardi F, et al. A comprehensive overview on antibody-drug conjugates: from the conceptualization to cancer therapy. Font Pharmacol. 2023;14.

Gogia P, et al. Antibody–Drug Conjugates: A Review of Approved Drugs and Their Clinical Level of Evidence. Cancers (Basel). 2023; 15(15): 3886.

Australian Register of Therapeutic Goods (ARTG), March 2024.

Amgen Inc. v. Sanofi, 598 U.S. 594 (2023).

For example, in Australian Patent 2015274506 granted claims surviving a patent opposition are directed towards an ADC comprising the antibody (i.e., trastuzumab), the linker and payload (i.e., PEGx-MMAE, PEG3c-MMAE or a 3-arm PEG linker), and the site-specific place of attachment (i.e., endogenous acceptor Gln295 flanked by an N-glycosylation site at position 297 in the Fc region of the antibody).